Mortgage rates have settled in the mid-6% range, shaped by shifting Federal Reserve policy, changes in bond market expectations, and the stubborn reality of inflation pressures. For residents of the Devonshire HOA in Kaufman County, the coming months may prove decisive for both refinancing opportunities and the pace of local home sales. Let's review the latest mortgage data, explain how Fed decisions ripple through financial markets, consider the uncertain path ahead, and address one paradoxical factor that could work against home values: buoyant stock market valuations.

Recent Mortgage Rate Trends

As of the week ending September 25, the Freddie Mac Primary Mortgage Market Survey showed the average rate on a 30-year fixed mortgage at 6.30%. The average for a 15-year fixed mortgage was 5.49%. Both rates remain well above the historic lows seen in 2020 and 2021, though they are down slightly from the peaks reached in 2023. The 30-year rate ticked higher from 6.26% the prior week, underscoring how responsive borrowing costs remain to shifts in financial markets.

For homeowners and buyers, this translates into affordability pressures. A family financing a $350,000 home in Devonshire at today’s average 30-year rate would face a monthly payment hundreds of dollars higher than they would have only a few years ago, even before accounting for property taxes and insurance.

How Fed Policy Shapes Mortgage Rates

Many residents wonder why mortgage rates seem to rise or fall in ways that don’t always match the Fed’s official announcements. The answer lies in the difference between short-term policy rates and the long-term bond yields that drive mortgage pricing.

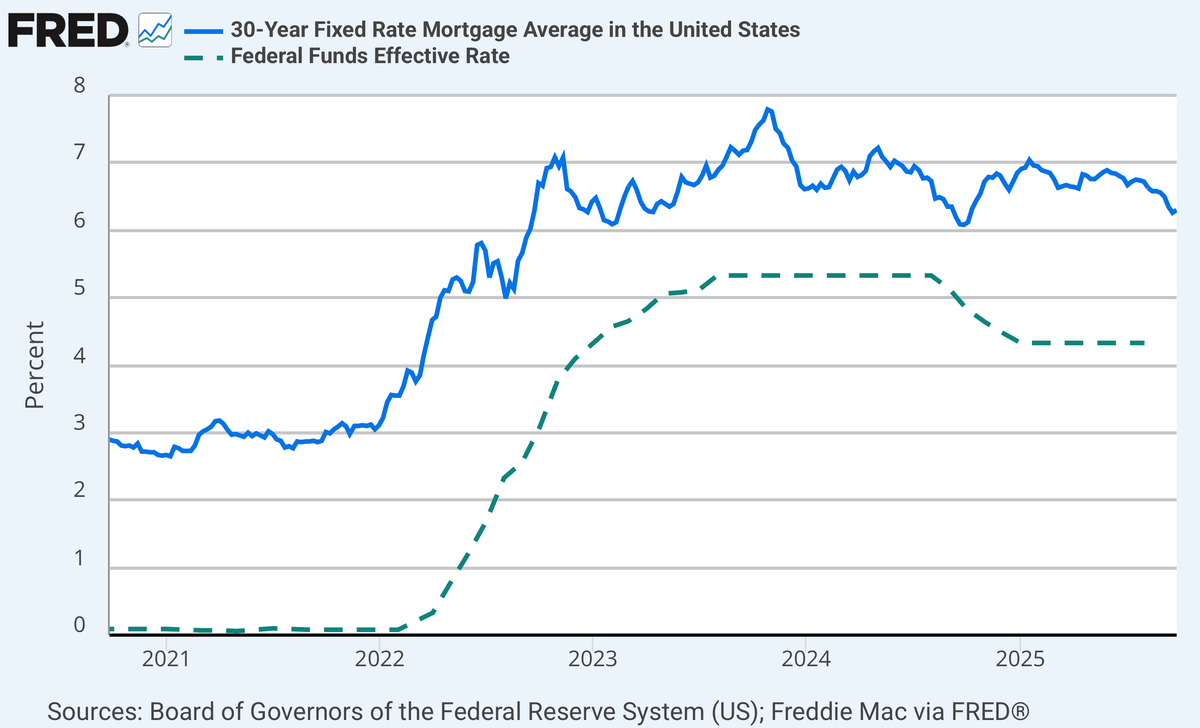

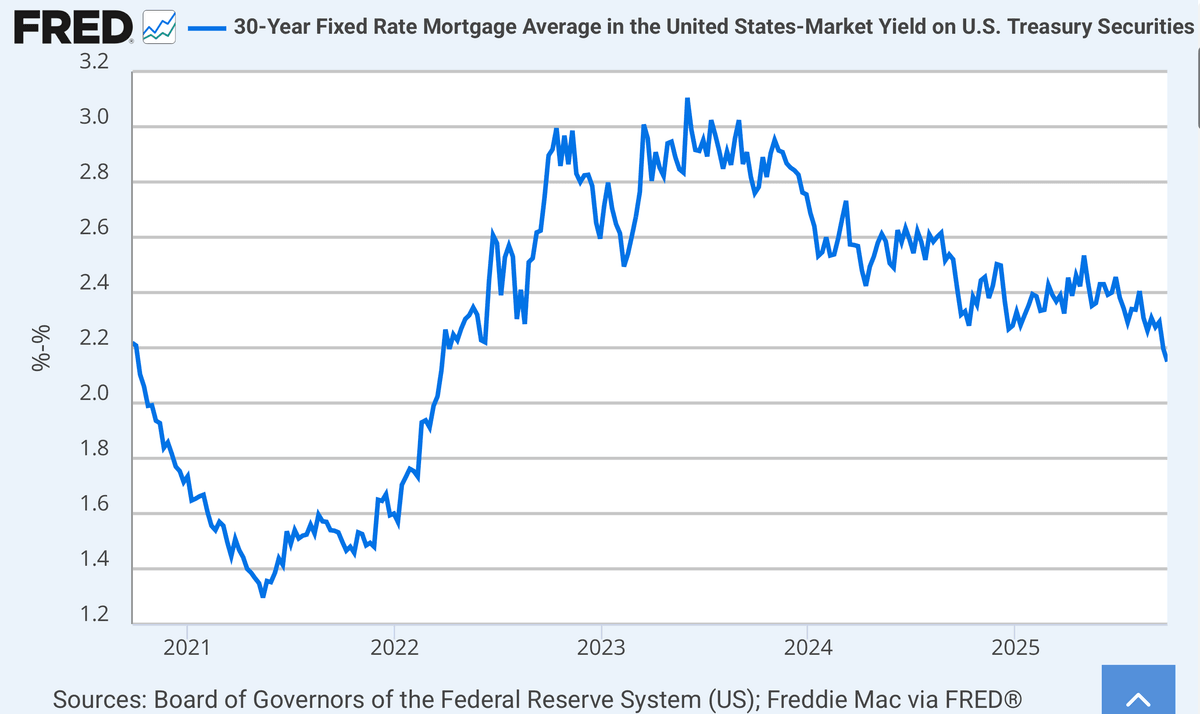

The Federal Reserve sets the federal funds rate, which influences overnight borrowing costs between banks. Mortgage lenders, however, do not lend at the federal funds rate. Instead, they price long-term loans off benchmarks such as the 10-year U.S. Treasury yield, adjusting for risk and servicing costs. In practice, mortgage rates usually track the 10-year Treasury yield plus a spread. As shown in the chart below, the spread between average 30-year fixed mortgage rates and the 10-year Treasury yield has narrowed in recent months. This tightening indicates that investors in mortgage-backed securities perceive less risk and volatility in the market, which can help keep mortgage rates more closely aligned with broader bond yields.

When the Fed cuts its policy rate, as it did in September with a quarter-point reduction, short-term yields generally move lower. But the longer-term bond market can react differently depending on investor expectations. If bond investors believe inflation remains a threat, they may push long-term yields higher, which can keep mortgage rates elevated even as the Fed loosens policy. If investors anticipate slower growth or reduced inflation, long-term yields may fall more sharply, bringing mortgage rates down. Mortgage lenders then add their own margins, which can widen or narrow depending on market volatility.

This is why Devonshire homeowners cannot assume that a Fed cut will automatically translate into cheaper mortgage rates. The connection is indirect, and it depends heavily on how bond markets interpret the Fed’s intentions.

The Uncertain Path Ahead

The September cut marked the Fed’s first reduction in more than a year, signaling concern about the pace of economic growth. Yet the road ahead is far from clear. Markets are divided about how aggressively the Fed will move in the coming months. Some analysts expect a steady series of quarter-point cuts designed to gradually ease financial conditions. Others believe the Fed may pivot more forcefully if economic data weaken, potentially pushing mortgage rates down faster. Still others caution that inflation remains sticky enough to prevent the Fed from cutting much further, leaving mortgage rates stuck in the six-percent range or even higher.

The wide range of possibilities means homeowners and buyers should brace for volatility. Mortgage rates may drift downward in one week only to snap higher the next. For those considering a purchase or refinance, this creates both opportunities and risks. Acting quickly during a dip in rates can lock in savings, while waiting for further declines may expose borrowers to sudden reversals.

The Stock Market Twist

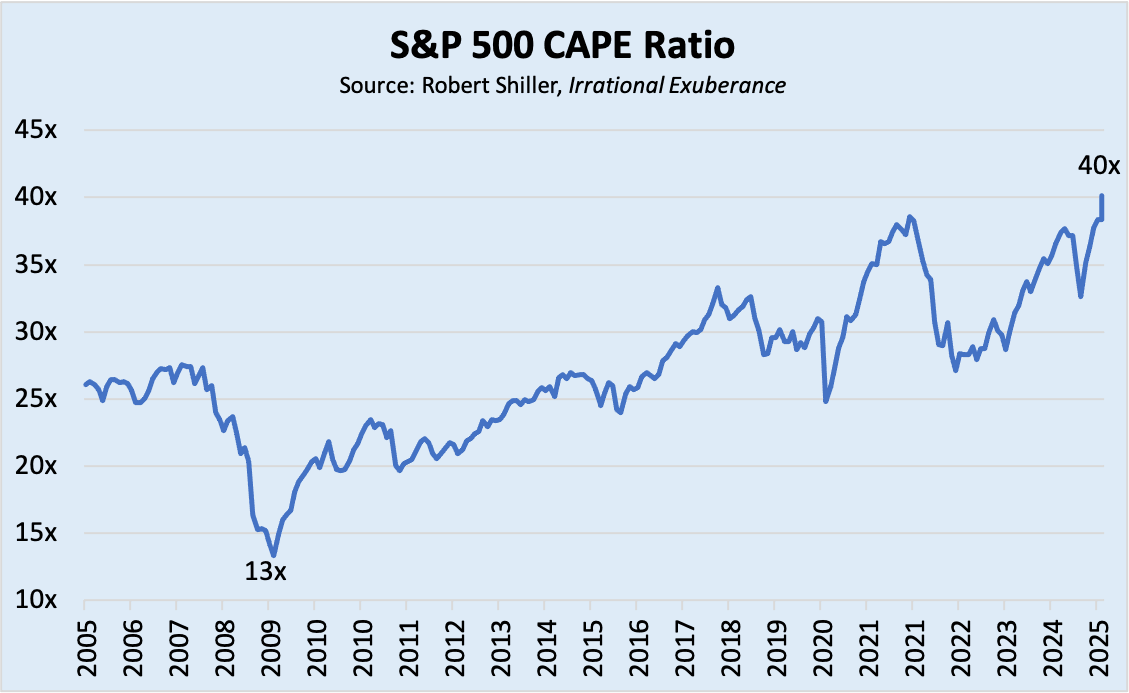

One underappreciated factor complicates the Fed’s choices: the strength of the stock market. In recent months, equity prices have surged to record highs, leaving valuations stretched by historical standards. Fed Chair Jerome Powell has commented that high asset prices and low risk premiums limit the central bank’s willingness to cut aggressively. The concern is that easier monetary policy could inflate bubbles in financial markets, increasing risks to the broader economy. As shown below, the S&P 500 CAPE ratio, a long-term measure of stock market valuations, has surged from 13 in 2009 to around 40 today—a level that underscores the Fed’s caution about cutting rates too aggressively.

For Devonshire homeowners, this dynamic has a surprising implication. A booming stock market, while positive for investor portfolios, may actually delay relief in mortgage rates. If the Fed hesitates to cut because stocks are soaring, long-term yields may stay elevated and mortgage borrowing costs may not decline as quickly as households hope. This, in turn, can dampen demand in the housing market, placing a ceiling on how fast home values can appreciate.

What It Means for Devonshire

In practical terms, Devonshire residents should prepare for a mortgage environment that remains higher than many expected at the start of the year. Refinancing opportunities may open briefly if rates dip closer to six percent, but those windows may not last long. Buyers considering a move into the community should weigh whether to act now or wait, balancing the risk of slightly lower rates in the future against the possibility of prices firming further.

The silver lining is that Devonshire’s appeal—its amenities, schools, and community character—continues to support local property values even amid national rate uncertainty. While higher borrowing costs may cool demand, the neighborhood’s desirability provides a measure of resilience.

Conclusion

Mortgage rates today are the result of a complex dance between Fed policy, investor expectations, and the stock market’s exuberance. The September rate cut by the Fed was an important signal, but it did not deliver immediate relief in long-term borrowing costs. Going forward, Devonshire homeowners should expect a bumpy path, with mortgage rates moving in fits and starts depending on economic data and investor sentiment. Those who remain attentive and prepared to act quickly will be best positioned to take advantage of opportunities when they arise.

For personalized real estate advice from a Devonshire expert, call Brendan Hirschmann, REALTOR® at 972-559-4648. Brendan can provide you with the insights and guidance you need to navigate the current market trends and make informed decisions.