Why Leasing Your Devonshire Home Can Be a Smart Move When You’re Ready to Relocate

Why Leasing Your Devonshire Home Can Be a Smart Move When You’re Ready to Relocate

By Brendan Hirschmann, REALTOR®

For homeowners in Devonshire sitting on a sub-3% mortgage rate, moving in today’s market presents a dilemma. Mortgage rates remain elevated—averaging 6.15% for a 30-year fixed loan as of year-end 2025—while home prices have softened and inventory is tight. Selling outright may feel like leaving money on the table. But leasing your current home before buying your next one could unlock financial flexibility and preserve long-term value.

Leasing Trends in Devonshire: A Strong Market Signal

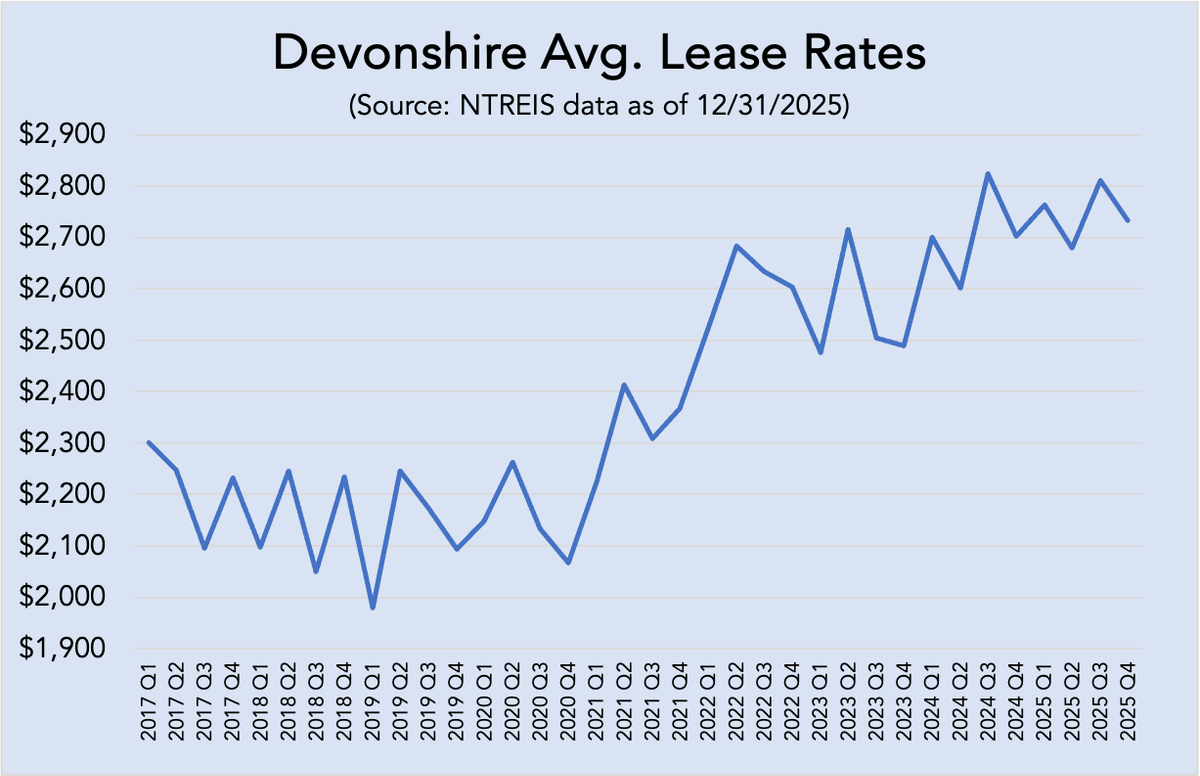

Recent data shows that leasing activity in Devonshire remains robust. Average lease prices have climbed steadily over the past three years, reaching $2,734 per month in Q4 2025, up from $2,489 in Q4 2023. Even with seasonal fluctuations, the trend is clear: demand for rentals in master-planned communities like Devonshire is strong. Current listings—18 homes available at a median price of $2,900 per month—suggest landlords can command premium rents for well-maintained properties.

This dynamic creates an opportunity for homeowners who want to move but hesitate to give up historically low mortgage rates. By leasing your existing home, you can offset carrying costs and potentially generate positive cash flow while transitioning to your next property.

Why Leasing Makes Sense When Rates Are High

- Preserve Your Low Mortgage Rate: If your current mortgage is locked below 3%, selling means surrendering that advantage. Leasing allows you to keep that financing in place while benefiting from rental income that often exceeds your monthly payment.

- Offset Carrying Costs During Transition: Negotiating seller credits on your next home can help cover the gap between closing and securing a tenant. Credits can be applied toward mortgage payments, HOA dues, or initial maintenance costs—making the move less financially stressful.

- Leverage Low Down Payment Options: FHA, VA, and certain conventional programs allow for down payments as low as 3–5%. Pairing these with seller concessions can reduce upfront cash requirements, freeing you to hold your Devonshire property as an income-producing asset.

For personalized real estate advice from a Devonshire expert, call Brendan Hirschmann, REALTOR® at 972-559-4648. Brendan can provide insights and guidance to help you navigate current market trends and make informed decisions.